How to Create Your Own Financial Plan

What is financial planning?

Financial planning is relevant, in one way or another, to every single one of us: whether you are affluent, struggling financially or anywhere in between.

Of course, in an ideal world, everyone would have access to a financial planner to help with the drafting of a financial plan to address those needs and goals that are relevant and unique to you. But while the role of a financial planner may be one of the top finance jobs, the reality is that financial planners rarely offer their services on a pro bono basis which means that many people do not have the means to engage a financial planner. The irony of the situation is that those who need the assistance, guidance and advice the most are often in the least favourable position to be able to afford the services they desperately need.

Does this mean you should not make your financial planning needs a priority or that they are less important? Absolutely not. Everyone’s lives are unique – you have your own goals, dreams and hopes. Even though a comprehensive financial plan may not be within your reach at the moment, you can still take steps to start taking control of your financial futures.

6 steps to financial planning

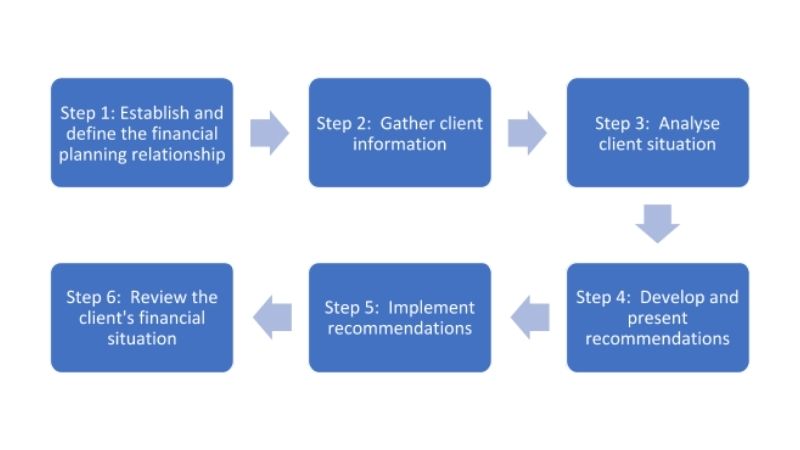

A thorough financial planning process would usually entail six steps. You will find that professional financial planners all employ this process in their engagement with clients:

Advice or recommendations about the most suitable solutions (Step four: Develop and present recommendations) would usually rely on expert knowledge and experience that should ideally be provided by a financial planner. Remember, though, that solutions are not necessarily products. A product is not the answer to every need – help with making a budget work or with building good financial habits can often add the most value to a particular person. Paying attention to your money behaviours is sometimes the most valuable step you can take towards meeting your goals.

Is it ideal to go through this full process with an experienced, knowledgeable planner? Yes. Can everyone afford it? Realistically, no.

Can you, however, do a broad financial wellness check yourself in order to identify areas of risk or need without the input and cost of a financial planner? Absolutely. Additionally, you can take a financial planning course that will teach you the basics of financial planning and how to take control of your personal finances. In this way, you can interrogate some aspects related to the process yourself and only use a financial planner for those vital steps that you should ideally not do yourself.

Learn Financial Planning

Master the building blocks of financial planning and learn how to take control of your personal finances.

By identifying your needs and goals yourself, you can approach a financial planner for advice on suitable solution options only. This can prove a much more cost-effective way of addressing your financial needs.

The reality is that most people have multiple financial planning needs without the capacity to address all needs immediately. An experienced financial planner can provide valuable guidance with the prioritisation of your identified needs.

The important thing with financial planning is to start. Just start. Assessing your current financial wellness position is a very good first step.

Want to learn more? Join our online Financial Planning course today!

Originally published on Benzinga.com.