How to become a certified Bookkeeper

‘Making good judgments when one has complete data, facts and knowledge is not leadership – it’s bookkeeping,’ there are the wise words by Dee W Hock, founder and former CEO of the Visa Credit Card Association.

It’s interesting to note that the top two reasons businesses fail revolve around finance management, one being poor cash flow management and the second is simply losing control of the finances.

It is recorded that 82% of business failures are due to poor cash management, which includes the ineffective management of debtors, high stock levels, bad debt, late invoicing and inadequate financing.

With these figures in mind, bookkeeping seems to be a valuable role which many businesses will require to prevent catastrophic failure. If you are looking to get into bookkeeping keep reading as we take you through how to become a certified bookkeeper.

In this blog, we are going to cover:

What is bookkeeping?

Bookkeeping is the practice of recording, storing, retrieving, keeping and analysing the financial records of a company. Each transaction is extremely important and every cent must be accounted for, thus making bookkeeping the perfect tool to analyse the financial status of a company, or that of your personal wealth, to determine the next steps and promote company growth.

What a bookkeeper does?

Bookkeepers, simply put, keep track of and record the day to day flow of money. These records are then used by accountants and the company executives to make important business decisions.

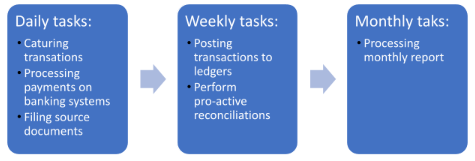

Typically a bookkeepers month would comprise the following activities:

Staying on top of this process throughout the year makes the year-end process more manageable and less stressful.

Essentially the bookkeeper prepares the documents for the accountant. Using the documents and ledgers compiled by the bookkeeper, the accountant will:

- Prepare tax returns

- Organise financial records

- Examine financial statements

- Evaluate the company’s financial status

Both roles serve a unique and important purpose. Each contribution, as noted in our statistics provided above, can help prevent the financial ruin of an organisation.

If you are an attention-to-detail-math-boffin that likes routine, your purpose in life might well be to become a bookkeeper and rescue your fellow citizens from financial ruin.

How to become a bookkeeper

Surprisingly an entry-level bookkeeper does not require a formal qualification or degree. This means that theoretically with adequate knowledge you can start your bookkeeping career immediately.

The reality, however, is that most companies want to entrust their financials to someone with a little experience and thorough knowledge of bookkeeping and accounting principles, preferably verifiable. For these reasons some bookkeepers seek to attain the status of Certified Bookkeeper.

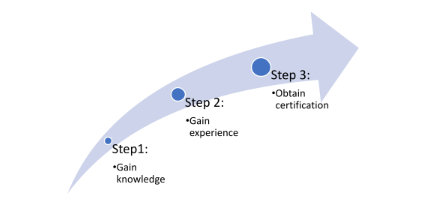

To go from newbie to Certified Bookkeeper is thankfully a simple 3 step process, though it might take some time.

Step 1: Gain knowledge

It is true that your High School Diploma is sufficient to secure an entry-level bookkeeping position. The High School Diploma provides adequate training on all the required skills to become a bookkeeper including math, writing and communication, time management, organisation and teamwork.

As we stated earlier, essentially you can start right away, and our recommendation is to simply approach your own personal finances as that of a customer’s. Get into an accounting routine by recording and reconciling your transactions. You can even compile reports to project your financial growth. Your personal finances is a great place to test theories, routines and techniques giving you both knowledge and experience in the basics of accounting.

To pursue a career, whether as an employee or freelance bookkeeper, further investment in your education is worth the effort.

Obtaining a degree, diploma or completing an online course is not only proof of your acquired knowledge, it also shows your commitment to your profession and willingness to learn.

Depending on your available resources and projected timeline, the following options are available:

Certified Online Course | Completing a Certified Online Course may be the fastest and easiest way to gear up for your bookkeeping career. Be sure to choose a course that covers all the essential knowledge and skills required to become a competent bookkeeper. We recommend the globally recognised Accounting & Bookkeeping Course from Upskillist. |

Undergraduate Degree | An associate degree in bookkeeping or accounting delivers the necessary knowledge and job skills in about two academic years. |

Bachelor’s Degree | If your aim is to eventually become an accountant, it’s best to opt for a four year Bachelor’s degree, to learn the profession in deeper detail. |

Once you have your education path set, it’s time to invest in your work tools including:

- Good computer equipment

- Reliable internet connection

- Phone and communication infrastructure

- Versatile accounting program or software

The core function of accounting and bookkeeping has remained the same for centuries, though the methods and systems used have evolved considerably. Software tools will help streamline your accounting processes, ensure efficiency, accuracy and security.

Though bookkeeping is an excellent and high in demand profession, it is predicted to decline by 3% in the US from 2020 to 2030. Ensure that you have an edge in your service offering by making use of innovative technology, increasing your chances of sourcing and maintaining a bigger client base, not to mention mitigating the risk of losing data as a result of inadequate security or old equipment.

When considering software or programs, it’s suggested to keep the following in mind:

- Cost of the program or software

- Availability of tools

- Usability and ease of use for both you and your client

- Data storage options

- Mobile options

- Collaboration and integration options

When starting out, choose an option that is affordable and easy to work with. It is important to keep your desired growth in mind as well and make sure that transition from your chosen system to another is possible, if the need arises.

Step 2: Gain experience

Once you have the required knowledge and software, it’s time to gain experience and learn the tricks of the trade.

If your goal is to become a Certified Bookkeeper you will need to build up between one and two years of working experience. To gain experience you may consider one of the following options:

Internship | With an internship opportunity you are able to secure an entry-level bookkeeping position while completing your studies, giving you the opportunity to learn and gain experience at the same time. |

Paid employee | A fixed position gives you the security of a steady income while gaining experience. The added benefit is the opportunity to learn from industry experts. You will most likely also work with a variety of clients, allowing you to gain experience in various business models. |

Freelance | Freelance positions present the possibility of a higher income but often requires a little more experience. |

Step 3: Obtain certification

To earn the title of Certified Bookkeeper you are required to gain 3000 hours of work experience, pass an exam and commit to a code of ethics.

Upon completion of your exam you will be able to put the letters CB – Certified Bookkeeper or CPB – Certified Professional Bookkeeper behind your name and display this on your resume.

Recommended institution | Ideal candidate | Certification |

Best for individuals with no formal education in bookkeeping. | Certified Bookkeeper (CB) | |

Best for individuals with a bachelors or associate degree in accounting. | Certified Professional Bookkeeper (CPB) |

As noted previously, bookkeeping as a profession can be pursued with no qualification and zero certification, but any investment made in your abilities will add to your success and help you secure high-end clients. Certification provides a sense of security to your clients, indicating that you are both skilled and experienced, and that you work on an internationally accepted and recognised standard.

As with any industry, clients are willing to pay extra for security. Meaning your potential earnings is directly linked to the qualification and experience you gain.

How much do bookkeepers make

So the road to becoming a bookkeeper and certified bookkeeper is pretty straight forward, but is it financially viable?

According to Ziprecuirter the national average income of a freelance bookkeeper in the United States is $55,094 per year or $26 per hour. Bookkeepers in a permanent position earn an average salary of $40,406 per year, or $19 per hour.

With your acquired knowledge of bookkeeping, you can of course pursue a career as an accountant in which case the average earning potential is around $73,560 per annum.

Conclusion

Bookkeeping encompasses skills and knowledge that is greatly beneficial to any organisation and therefore presents several career opportunities, including accounts receivable clerk, auditor, cost estimator, accounting clerk, budget analyst, loan officer, tax examiner, payroll clerk, brokerage clerk and more. At the same time these skills are transferable and beneficial to ensure your own financial freedom. The best is that to become a bookkeeper, you really only need the motivation and determination to start. Taking one step at a time you can work your way up from average person to Certified Bookkeeper to Accountant in three to four years.

As the saying goes, behind every good business is a great bookkeeper. Ready to upskill in bookkeeping? Learn more about our Online Bookkeeping and Accounting Course.