Bookkeeping Basics: Everything a Small Business Owner Should Know

What is bookkeeping?

The concept of bookkeeping has existed for thousands of years dating back to Ancient Mesopotamia, where they used clay tokens as a form of recording information and as a means of tracking their agricultural goods.

The need to record and track information is becoming increasingly pertinent in the modern world whether you are a small startup, an entrepreneur wondering how to start a business with no money, or a conglomerate, and so resulting in the evolution of bookkeeping, which is now performed using what is known as the double-entry system.

Bookkeeping is the process of recording, classifying, and reporting of financial transactions in a business. It helps business owners monitor the financial health of the business and provides insight into the economic activity of the business, which helps with analysis and decision-making.

Bookkeeping basics: where to begin?

Now you have taken the brave step to register your business and you are ready to hit the ground running, but where do you start?

You need to begin by setting up the chart of accounts. The chart of accounts is an index of all the accounts the business will use for capturing transactions.

Typical transactions you can expect to encounter as a small business:

- Salaries and wages

- Rental

- Insurance

- Stationery

- Telephone

- Settlement of debts to suppliers and lending institutions

- Invoicing customers for products sold or services rendered

- Retained earnings

- Other cash payments and receipts

Appendix 1 contains an example template of the chart of accounts. You will use the chart of accounts to determine which is the appropriate one against which to reflect your transactions.

Learn Bookkeeping & Accounting

Understand basic bookkeeping principles and learn how to confidently manage your personal finances.

The double-entry system

Now, the real question is how you practically capture the transactions. Bookkeepers and accountants alike use the double-entry system, made popular by Luca Pacioli, earning him the prestigious title of the 'father of accounting and bookkeeping'. He documented the double-entry system in a 27-page manuscript in 1494. That system is still used today, and, in a nutshell, it is the process of reflecting a credit entry for every debit entry recorded in the accounting books.

What is the difference between debit and credit?

The most difficult terms to explain, in the accounting world, are debit and credit. However, they are the foundation of every single transaction that ever makes it into annual financial statements. Simplistically, the terms debit and credit are a way to describe the impact of a financial transaction on the elements in the financial statements. Here is a simple example.

If you purchased a desk and chair for the office at the furniture store for $1,500 on credit, you would capture this transaction as follows in your general ledger:

Dr Furniture and fittings (asset) 1,500.00

Cr Accounts payable (vendor) 1,500.00

Desk and chair purchased for the office and classified as assets.

The entry above is known as a journal entry.

The challenge comes with knowing what impact a debit or credit has on each element in the accounting records. Here is a cheat sheet for you to use:

| ELEMENT | DEBIT | CREDIT |

|---|---|---|

| Assets | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Equity | Decrease | Increase |

| Income | Decrease | Increase |

| Expenses | Increase | Decrease |

What is the accounting equation?

Another way to assess the impact of transactions is to use the most fundamental concept in bookkeeping known as the accounting equation. The accounting equation ensures all your journal entries balance, which results in accurate and complete accounting records. If you understand the accounting equation, there is not a journal entry you will not be able to capture and reflect. The equation states:

ASSETS = LIABILITIES + EQUITY

If you consider the example from the previous section, this is how the transaction will be reflected in the accounting equation:

$1,500 = $1,500 + $ 0

This indicates that the transaction has been correctly assessed and captured as the accounting equation balances.

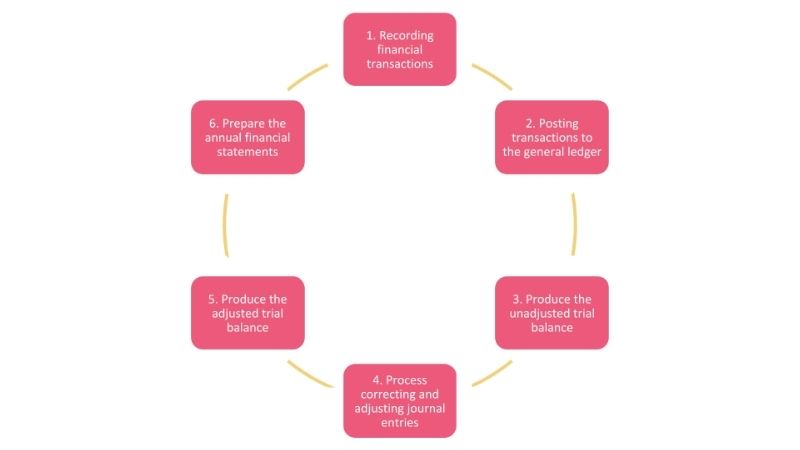

The accounting cycle

Bookkeepers are generally humans that are sticklers for routine. As bookkeeping is a cycle, each transaction goes through a monthly and annual cycle in order to end up in the annual financial statements. There are six key steps in the accounting cycle from capturing through to the preparation of the annual financial statements:

The end goal

So, why do we do this day-in and day-out, all year round? Well, the key deliverable out of each financial year of operation is the production of the annual financial statements. It comprises financial and non-financial information regarding the assets, liabilities, equity, income, and expenses of a business.

Details around the assets, liabilities, and equity can be found in a report called the Balance Sheet or Statement of Financial Position. It gives insight into the financial position of the business at that point in time, for example, at the end of the financial year.

The income and expenses of a business are detailed in the Income Statement or Statement of Comprehensive Income, and it reflects how well the business performed during the financial year as it indicates whether you have made a profit or loss.

The third key report is called the Statement of Cash Flows. It depicts the operating, investing, and financing cash flows of the business during the financial year.

The fourth and final report is known as the Statement of Owner’s Equity, which shows the contributions made by the owner, drawings taken from the business, and retained earnings, which is the accumulation of the profits and losses from each financial year.

Bookkeeping software and systems

Fortunately, as bookkeeping and business has evolved, so has technology. Long gone are the days of purchasing physical books and handwriting your journal entries. Bookkeeping software is becoming more affordable and more popular amongst small business owners.

The benefits of using bookkeeping software include:

- Built-in validations to ensure the double-entry system is applied

- Guided setup process to easily set up and maintain the chart of accounts

- Automate otherwise manual tasks such as posting your journal entries to the general ledger

- Automatically maintains your general ledger and trial balance

- Minimises the risk of human error and increases the accuracy of reporting

- Can easily extract reports from the system

- Creates a clear audit trail

- Aids in quicker and easier tax submissions

- Maintains backups of your data to protect you against loss and corruption of your information

And the benefits can go on and on, but the bottom line is that systems are a more effective means of accessing and monitoring your financial data.

Albeit not that glamorous, bookkeeping is one of the most critical functions within a small business to ensure sustainability and success. Your financial information is widely used especially by lenders when you need to apply for that extra bit of financing. If you do not maintain your records, the Revenue Service will almost definitely be after you. So, whether you intend to hire a bookkeeper, outsource the bookkeeping function, or attempt to do it yourself, make sure you set yourself up for success!

Want to learn more? Join our top-rated online Bookkeeping course today!