Bookkeeping Guide: How to manage your eCommerce store's books

Ever reach the end of the month and wonder where your biggest expenditures lie? Whether you’re struggling to make ends meet or are making more money than you can keep track of, there is a big need for you to keep track of the money flowing in and out of your accounts.

There are several high-quality resources available online for learning all of the skills and information required to become a bookkeeper or at least gain the knowledge and skills to perform the tasks yourself with the help of online tools (there are many and you don’t have to worry about understanding accounting on the level of a Chartered Accountant).

It is rather important to attend classes that teach both fundamental bookkeeping and advanced accounting. Classes that a person should concentrate on include:

- Payroll Fundamentals

- Accounts Management

- Excel Fundamentals

- Reconciliation of Bank Accounts

- Credit Management

- Profitability and Strategic Planning

Keeping track of your and your business’ inflows and outflows of money is one of the most important aspects when you want to run a profitable business (or personal finances). The answer to this is effective bookkeeping. Before you get intimidated by the prospect of engaging with unfamiliar finance and accounting terms, never fear, for Upskillist is here to help! Let’s look at how you can keep track of your own, as well as your business finances – effortlessly.

What exactly is bookkeeping?

Bookkeeping in plain terms keeps track of all the inflows and outflows of money from your accounts. This includes everything – and we mean all of the in- and outflows – this includes:

- Sales revenue

- Salaries/wages

- Merchant fees

- Inventory management

- Shipping

- Sales tax

- Transactions in different currencies

- Rates and taxes (water, electricity, internet, phone, sewage)

- Refunds

The list of possible inflows and outflows is massive, and these are just the most common ones – but it’s very possible (and likely) that you might have some expenditure that is not listed here.

Bookkeeping keeps track of all the expenditures and inflows of money to your accounts throughout the year. This way at the end of your financial year (when tax season comes), you don’t have to scramble to get all the paperwork in order or call expensive accounting services to help you figure out how you managed your finances throughout the year.

Imagine at the end of every month you have a single page that lists all of your income and expenditures and indicates whether you made a profit or loss. Wouldn’t it be easier to cut certain costs and recognise which expenditures are excessive? Indeed, it will, and there are a multitude of resources to help you set everything up. To ensure that you are on the right track and understand the terms and principles that you should be comfortable with, we recommend taking a look at a bookkeeping course online, such as the one offered by Upskillist.

Bookkeeping for eCommerce

Setting up an eCommerce store requires much more than buying the domain and creating the website. eCommerce bookkeeping and accounting procedures are fairly similar to those used in other businesses. If you understand the fundamentals of bookkeeping or have past accounting experience, you’re well on your way to comprehending this topic. Even if you have no prior expertise, the concepts of retail accounting are pretty easy.

When you start setting up your bookkeeping, establishing a workflow that makes sense is a crucial step:

- Decide how you want to track the cost and quantities of inventory

- Sign up for retail accounting software

- Create invoice, sales order and receipt templates

- Start inventory tracking

- Create the three important financial statements: balance sheet, income statement and cash flow statement

Bookkeeping and the double-entry system

Each transaction is recorded in two or more accounts using debits and credits in double-entry bookkeeping. At least one account is debited, while at least one other account is credited. The total of the debits and credits must be balanced (equal to each other).

In double-entry accounting, debits and credits are entries made in account ledgers to record changes in value caused by business transactions. Let’s look at some examples:

- A renter who sends a rent check to a landlord, for example, would register a credit in the bank account on which the check is written and a debit in the rent cost account. Similarly, the landlord would put a credit in the tenant’s rent income account and a debit in the bank account where the cheque is placed.

- A copywriter spends $ 1 000 on a new laptop computer for their firm.

- They credit $ 1 000 to their technological expenditure account and debit $ 1 000 from their cash account.

- This is because their technological expense assets are now worth $ 1 000 more, but they have $ 1 000 less in cash.

Financial statements

The balance sheet, income statement and cash flow statement are the most significant financial statements that your business will utilise. Each of these statements keeps track of the inflow and outflow of money from your business. To better understand why we use each of these three statements, let’s briefly discuss each of the statements to truly grasp the necessity and objective of the statements.

Balance sheets

The balance sheet is a summary of the accounting equation, which is:

Assets = Liabilities + Owners Equity

Assets are those items that are “owned by a person or company, regarded as having value and available to meet debts, commitments, or legacies”. These are typically vehicles, property, tools, investments and office equipment such as furniture, computers and printers.

There are quite a variety of different assets, and to distinguish between the different types of assets, the accounting field classifies them as current and noncurrent assets.

Current assets are those assets that can easily be converted into cash. Examples of these are:

- A positive bank balance

- Inventory/Merchandise

- Debtors

- Prepaid expenses (tax in advance)

Noncurrent assets are also referred to as fixed assets and are somewhat harder to convert into cash. These are typically referred to as, such as:

- PPE (Property, Plant and Equipment)

- Commercial/residential property

- Long-term Investments

- Intellectual property such as patents

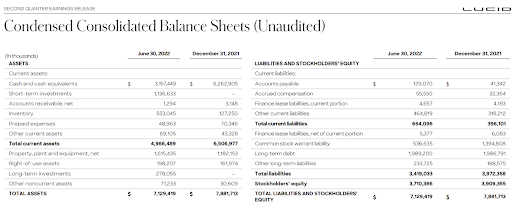

Remember, the accounting equation requires that assets are equal to liabilities + owners equity, and this is where the balance sheet gets its name from. The assets column and the liabilities + owners equity columns must be equal. If not, there is an error in the entries. Look at the example below for a clearer understanding:

Income statement

The income statement is divided into four sections: revenue, costs, gains, and losses. It makes no distinction between cash and non-cash revenues (cash vs. credit sales) or cash vs. non-cash payments. It begins with sales data and works its way down to net income and, finally, earnings per share (EPS). Essentially, it accounts for how the company’s net sales are translated into net profitability.

Your income statement comprises all of the money earned within a specific period, such as a month, quarter, or year. This report includes both operational and non-operating income.

- Operating income is defined as any money earned via normal company activities; for example, if you operate an e-commerce retail firm, your major operating income comes from inventory sales.

- Non-operating income is money earned that is not directly related to your company activity. In the case of a retail store, non-operating revenue may include property sales, equipment sales, or investment returns.

Cash flow statement

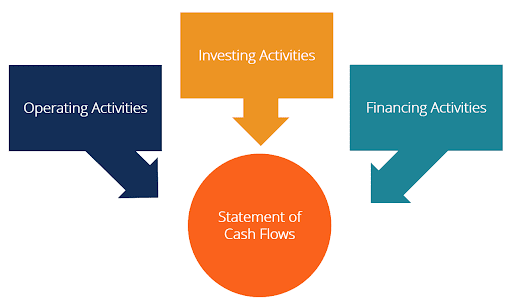

The Statement of Cash Flows (also known as the cash flow statement) reports the cash earned and spent during a certain period (e.g., a month, quarter, or year). The statement of cash flows serves as a link between the income statement and the balance sheet by displaying how money entered and exited the organisation.

- Operating Activities: An organisation’s primary revenue-generating activities as well as any non-investment or financing activities; any cash flows from current assets and current liabilities.

- Investing Activities: Any cash flows resulting from the purchase and sale of long-term assets and other investments that are excluded from cash equivalents.

- Financing Activities: Any financial flows resulting in changes in the amount and mix of the entity’s contributed equity capital or borrowings (i.e., bonds, stock, dividends).

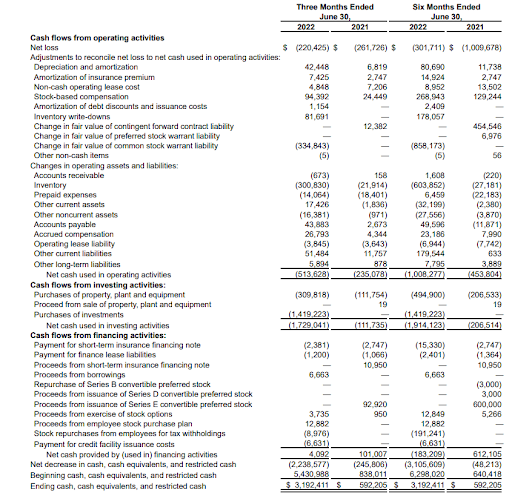

To better understand the statement of cash flows, it helps to compare year-on-year performance. The below image is an excerpt from Lucid Motors Q2 report and indicates the growth of the business in terms of investments, revenue from operating activities and financing activities such as shareholder investments and loans.

International reporting standards for Publicly Listed companies

IFRS is an abbreviation for International Financial Reporting Standards. The International Accounting Standards Board (IASB) is the IFRS Foundation’s accounting standards organisation.

The International Accounting Standards Committee, which preceded the IFRS Foundation, was established in 1973. Accounting bodies from Australia, Canada, France, Germany, Japan, Mexico, the Netherlands, the United Kingdom, and the United States were among the first to join.

Today, IFRS has become the global standard for the standardisation of financial statements for public companies, with 144 of 166 nations requiring IFRS standards at financial year-end.

IFRS has been adopted by fifteen of the G20 countries. National accounting rules identical to IFRS exist in China, India, and Indonesia, whereas Japan enables enterprises to follow the standards voluntarily. Foreign-listed corporations in the United States are permitted to adopt IFRS.

IFRS is a standard-based approach paradigm that is utilised globally, whereas GAAP is a rule-based system developed in the United States.

The IASB does not set GAAP and has no legal power over it. The International Accounting Standards Board (IASB) is a powerful organisation of professionals who debate and create accounting regulations. However, many individuals do pay attention to what the IASB has to say about accounting.

IFRS vs GAAP: Most significant considerations

Some major differences exist between the two sets of accounting standards. These include:

Inventory:

The first is with the LIFO Inventory. GAAP allows companies to use the Last in, First out (LIFO) as an inventory cost method. But LIFO is banned under IFRS.

Development costs:

Under GAAP, these costs are considered expenses. Under IFRS, the costs are capitalised and amortised over multiple periods. This applies to the internal costs of developing any intangible assets.

Write-downs:

GAAP specifies the write-down amount of an inventory or fixed asset can’t be reversed if the market value of the asset subsequently increases. On the other hand, the IFRS allows the write-down to be reversed. This results in inventory values fluctuating more frequently under IFRS than under GAAP.8

Fixed Assets:

Under GAAP, fixed assets such as property, plant, and equipment (PP&E), must be recorded at historical cost (the purchase price) and depreciated accordingly. Under IFRS, fixed assets are also valued at cost, but companies are allowed to revalue fixed assets to the fair market value.

Conclusion

Proper bookkeeping provides businesses with a trustworthy way of measuring their success. It also gives data for broad strategic decisions, as well as a baseline for sales and income targets. In summary, once a business is up and going, it is vital to invest extra time and money in maintaining good records.

Because of the high expense of hiring full-time accountants, many small businesses do not hire them. Small businesses, on the other hand, usually engage a bookkeeper or outsource the function to a professional agency. One thing to bear in mind is that many people who want to start a new business forget the necessity of things like keeping track of every cent spent.